Over the course of 2020 and 2021, the Australian press has regularly been referring to the Dutch Disease.

So, it interesting to see what this means and where the expression comes from

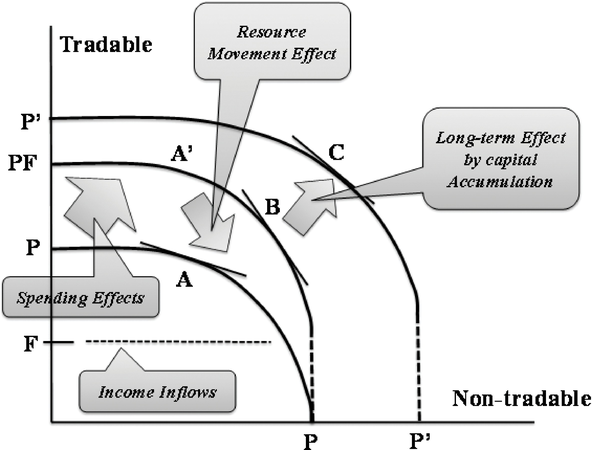

It is a way of describing the paradox which occurs when good news, such as the discovery of large oil reserves, harms a country’s broader economy. It may begin with a large influx of foreign cash to exploit a newfound resource.

The term was first coined by The Economist magazine in 1977 when the publication analysed a crisis that occurred in The Netherlands after the discovery of vast natural gas deposits in the North Sea in 1959. The newfound wealth and massive exports of oil caused the value of the Dutch guilder to rise sharply, making Dutch exports of all non-oil products less competitive on the world market. Unemployment rose from 1.1% to 5.1%, and capital investment in the country dropped.

The reason why we are now seeing this used by the Australian press is, that the country is making a lot of easy money out of coal and liquid natural gas. Exports are healthy, prices buoyant and provides a very lucrative trade surplus.

So here is the paradox: will the nation’s short-term abundance of fortune lead it to make poor decisions for the future? Many in the press are warning about this. According to them all odds (and lessons of recent political history) are on yes. But who knows? A savvy federal treasurer, aided by an equally smart one in the country’s biggest state, just might be able to engineer a way forward.

It is hard for politicians to not use the windfall to their political advantage, but in the process they can harm the country over the longer term. Here are a few examples from Down Under

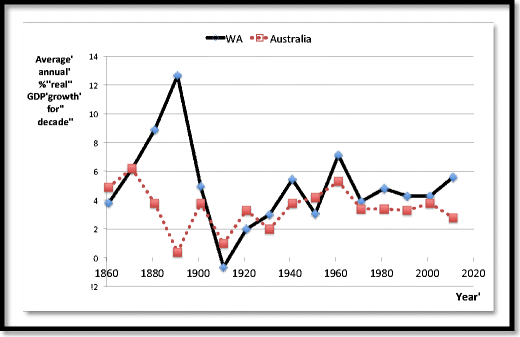

- Various Australian gold rushes in the 19th century, which saw whole bank sectors in Melbourne and Brisbane collapse.

- Australian minerals boom in the 2000s and another one in 2011.

Here are a few international examples as mentioned in Investopedia.

In the 1970s, Dutch Disease hit Great Britain when the price of oil quadrupled, making it economically viable to drill for North Sea Oil off the coast of Scotland. By the late 1970s, Britain had become a net exporter of oil, though it had previously been a net importer. Although the value of the pound skyrocketed, the country fell into recession as British workers demanded higher wages and Britain’s other exports became uncompetitive.

In 2014, economists in Canada reported that the influx of foreign capital related to exploitation of the country’s oil sands may have led to an overvalued currency and a decreased competitiveness in the manufacturing sector. Simultaneously, the Russian ruble greatly appreciated for similar reasons.4 In 2016, the price of oil dropped significantly, and both the Canadian dollar and the ruble returned to lower levels, easing the concerns of Dutch disease in both countries.

So the lessens learned from the Dutch Disease are often not followed up. A great exception is Norway that has invested their enormous economic windfall from their oil reserves in long term benefits for the country.

Paul Budde (10/2021)